These are challenging times for industry as a whole but especially so for the sports nutrition sector. It has been disproportionately impacted by a series of lockdowns and COVID related restrictions.The pattern of disruption is set to continue well into 2021, so what has been the impact of COVID on sports nutrition thus far and what might the future hold?

The impact of COVID on sports nutrition

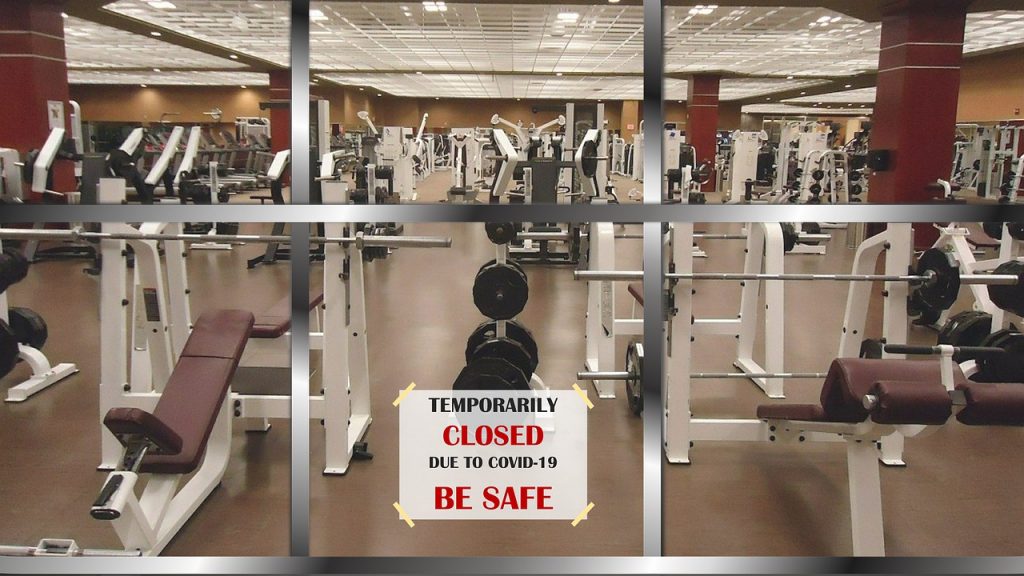

Gyms across the country have been forced to repeatedly close or when allowed to open, only do so under tightly controlled conditions.

No wonder then that businesses such as The Gym Group (Britain’s largest operator of low cost gyms) recently reported that revenues almost halved last year. Whilst member numbers have plunged by more than 200,000 due to the pandemic.

Since a large proportion of those purchasing sports nutrition products are regular gym goers, demand for such products has understandably seen a significant drop.

Those individuals that have carried on working out have been forced to do so at home, driving a dramatic increase in gym equipment sales. This was particularly evident during the early part of the lockdown as people sought to maintain their training and fitness.

Others, forced into lockdown and furlough, have taken the window of permitted daily exercise as an opportunity to increase out-door activities such as walking and cycling.

Many ‘non-essential’ retailers have remained closed or have had sporadic opening. Grocers were largely unaffected by the restrictions seeing their overall food sales increase. However, their sports nutrition sales have still seen a general drop.

According to Kantar data, powdered drinks and protein powders were down as much as 32% versus the same period a year earlier, while RTDs and bar sales were down more than 25%.

Those sports nutrition businesses heavily exposed to smaller bricks and mortar retail have suffered worst, compounded by the rapid acceleration towards online sales.

What’s next for sports nutrition?

It’s likely that when COVID is finally under control gyms and leisure centres will return to something approaching normality as people locked up for months seek social contact.

However, the hangover from COVID may well remain. Many of those that left the gyms and other sports venues could be in no hurry to return, still being fearful and having been ‘coached’ into avoiding ‘unnecessary’ contact.

Many may wait to see what ‘safety’ measures venues put in place or whether the vaccine is fully effective. Others may not return at all.

This mind set should continue to support growth in home gyms, remote exercise and virtual classes e.g. Peloton and Joe Wicks style workouts.

There will also inevitably be a wide ranging impact on disposable incomes as unemployment rises. This will further encourage comparison shopping online and an increasing shift to value-led products and brands.

How can sports nutrition businesses respond?

With change comes innovation; businesses will have to develop products and solutions that meet the needs of those less likely to visit the gym. Other product formats will need to be considered and as well as previously under the radar areas of nutrition.

Marketing messages will have to be aligned to the changing needs of such consumers in order to stay relevant. Those consumers seeking active nutrition will provide some opportunities for growth.

The shift to online sales will continue inexorably. Those businesses that can do so will need to increase their online offering, either through their own or 3rd party platforms.

Grocery and discount channels will grow in importance. One might consider them a defence, as other non-food channels remain vulnerable to potentially recurring restrictions or the appearance of new Coronaviruses.

These are indeed challenging times for the industry, with those businesses that fail to adapt looking at a potentially bleak future.

For new businesses that spring forth and existing businesses that that are able to respond and evolve, in their case opportunity knocks.